- Getting Started

- What is Investfly?

-

User Management

-

Market Analysis

-

Trading

-

Automated Strategies

-

Logical Expressions

- Custom Indicators

- Investfly SDK API Docs

Automated Trade

Automated trading is the simplest form of trade automation supported by Investfly. It involves a standalone trade order for a single security that is executed when the specified criteria are met. This type of automated trading order can also be referred to as a conditional trade order. If you have ever spent hours monitoring price charts for specific candlestick patterns or breakouts, automated trading will save you significant screen time. Investfly's algorithmic trading software can continuously scan price charts and execute orders based on your predefined trading strategy, allowing you to focus on other activities. Here are some examples of automated trading orders you can set up with Investfly, one of the best automated stock trading platforms and best algorithmic stock trading software available:

- Trade when stock price hits the upper resistance level

- Trade when stock price hits the lower bollinger band

- Trade when stock’s EMA 5 crosses over EMA 14

- Trade when stock drops by 10% over 6-day period

Supported Security Types

Investfly supports automated trading for Equities (STOCK, ETF) and Options. For options, the criteria should be based on the underlying equity’s price, not the option price. This is because Investfly continuously pulls and processes quotes for equities (stocks, ETFs). While Investfly can retrieve option prices on-demand (e.g., when a manual option order is submitted), it does not continuously pull option prices for all available options with various expiry dates and option chains in the market.

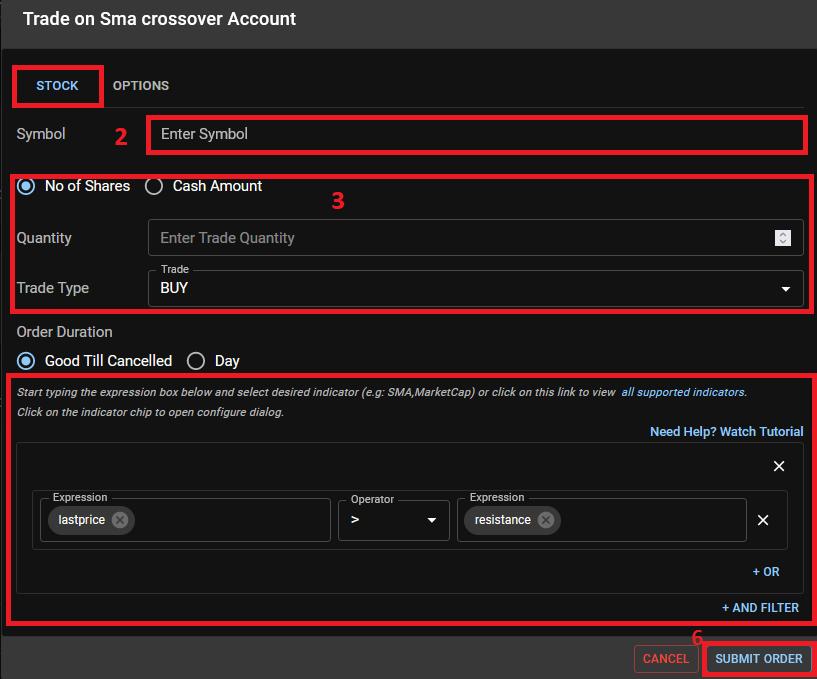

Submitting Automated Stock Trade

Automated trade can be submitted from Portfolio Dashboard or stock lists (see Trading from Stock Lists ).

- Click on Automated Trade button

- Enter the stock symbol

- Enter Quantity and Trade Type

- From the slider, select one of predefined template (e.g Break Resistance) or click on ‘Create From Scatch’

- Expression Builder will appear. Please read more on Expression Builder on how to create logical expressions.

- Click on Submit Order

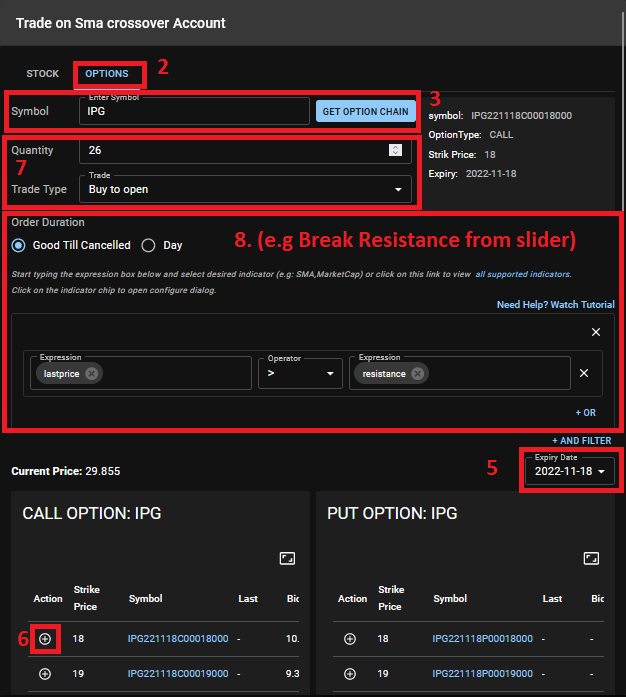

Submitting Automated Stock Trade

Automated trade can be submitted from Portfolio Dashboard or stock lists (see Trading from Stock Lists ).

- Click on Automated Trade button

- Click on Options tab

- Enter stock symbol and click Option Chain.

- Option Chains will appear on the table below

- Change the expiry date as desired using dropdown on the top right of the table.

- Select desired option by clicking on the icon on the first column.

- Enter quantity and trade type

- Below custom condition, from the slider, select one of predefined template (e.g Break Resistance) or click on ‘Create From Scatch’

- Expression Builder will appear. Please read more on Expression Builder on how to create logical expressions.

- Click Submit Order