Algorithmic Trading Guides

Conditional Automated Trading System

Execute algorithmic trades automatically when your predefined market conditions and technical indicators trigger buy or sell signals.

Conditional automated trading is the entry-level form of algorithmic trading supported by Investfly's platform. It involves a standalone algorithmic trade order for a single security that executes automatically when your specified market conditions and technical indicator rules are triggered. This type of automated trading order serves as your first step into algorithmic trading without requiring you to build a complete trading strategy.

If you've ever spent hours monitoring price charts waiting for specific technical patterns, support/resistance levels, or indicator crossovers, our automated trading system will dramatically reduce your screen time. Investfly's algorithmic trading engine continuously monitors market data in real-time and executes your orders precisely when your predefined conditions are met, allowing you to focus on strategy development rather than constant market watching.

Popular Algorithmic Trading Conditions:

- Automated execution when price breaks above key resistance level (breakout trading)

- Algorithmic buy order when price touches the lower Bollinger Band (mean reversion strategy)

- Automatic trade when 5-period EMA crosses above 14-period EMA (golden cross signal)

- Trigger-based sell order when RSI exceeds 70 for overbought conditions

Securities for Automated Algorithmic Trading

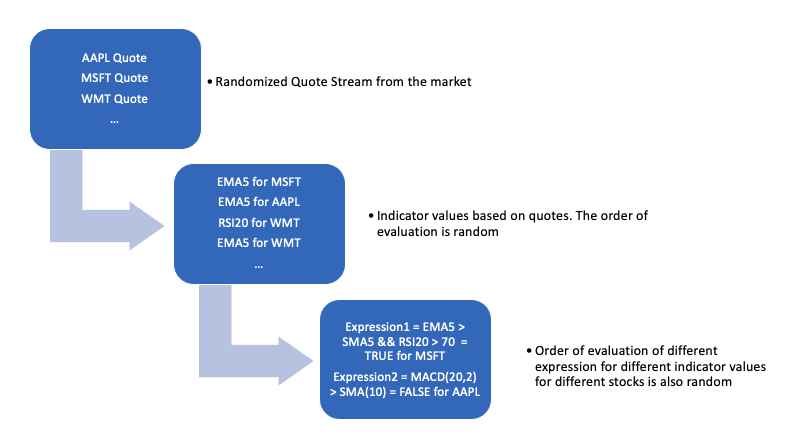

Investfly's automated trading platform supports algorithmic execution for both equities (stocks and ETFs) and options contracts. For options trading algorithms, your trigger conditions should be based on the underlying equity's price movements and technical indicators, not the option price itself. This is because our algorithmic trading system continuously processes real-time market data for thousands of equities, while option pricing data is only retrieved on-demand when placing actual orders. This architecture allows our automated trading engine to efficiently monitor the most liquid markets while still providing options trading capabilities.

Equity Algorithmic Trading

Automated execution for stocks and ETFs based on technical and fundamental triggers

Options Algorithmic Trading

Trigger-based options strategies using underlying stock conditions as execution signals

Creating Algorithmic Trading Orders

You can set up automated trading orders from your Portfolio Dashboard or directly from stock watchlists (see Trading from Stock Lists).

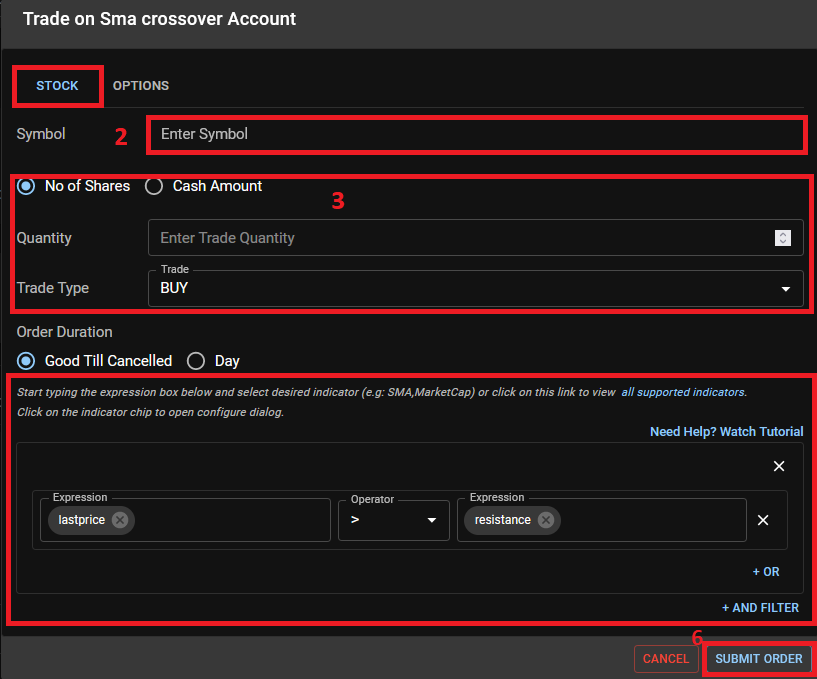

Step-by-Step Algorithmic Trading Order Setup:

- Click the "Automated Trade" button in your dashboard or watchlist

- Enter the security symbol for your algorithmic trade

- Specify your position size (quantity) and trade direction (buy/sell)

- Select from our library of pre-built algorithmic trading templates (like "Break Resistance") or choose "Create From Scratch" for a custom algorithm

- Use the Expression Builder to define your precise trading algorithm conditions with technical indicators, price patterns, and logical operators (see Expression Builder Guide)

- Finalize your automated trading order by clicking "Submit Order"

Algorithmic Trading Optimization Tip

For more complex algorithmic trading strategies with multiple entry/exit conditions across multiple securities, consider using our full Trading Strategy Builder. This advanced algorithmic trading tool allows you to create comprehensive trading systems with portfolio-level risk management.

Submitting Automated Option Trade

Automated option trades follow a similar process to stock trades, with a few additional steps to select the specific option contract.

Steps to Submit an Automated Option Trade:

- Click on the Automated Trade button

- Click on the Options tab

- Enter stock symbol and click Option Chain

- Option Chains will appear on the table below

- Change the expiry date as desired using dropdown on the top right of the table

- Select desired option by clicking on the icon in the first column

- Enter quantity and trade type

- Below custom condition, from the slider, select one of predefined templates (e.g., Break Resistance) or click on 'Create From Scratch'

- Expression Builder will appear. Please read more on Expression Builder on how to create logical expressions

- Click Submit Order

Automated Trade vs. Trading Strategy

Understanding the difference between a one-off automated trade and a full trading strategy is important for effective use of Investfly:

| Feature | Automated Trade | Trading Strategy |

|---|---|---|

| Duration | One-time execution | Continuous operation |

| Complexity | Simple, single condition | Complex, multiple conditions |

| Securities | Single security | Can monitor multiple securities |

| Exit Rules | None (manual exit) | Automated entry and exit rules |

| Use Case | Simple opportunity capture | Complete trading methodology |

For more advanced automation needs, see the Create Trading Strategy guide.