Guides

Trading from Stock Lists

Quickly execute trades directly from your watchlists, screener results, and other stock lists within Investfly.

Investfly's algorithmic trading platform streamlines your trading workflow by allowing you to execute trades directly from various stock lists, eliminating the need to navigate to separate trading screens. This feature helps you act quickly on trading opportunities identified through your research.

Supported Stock Lists

You can execute trades directly from several types of stock lists in Investfly:

Watchlists

Your personally created and maintained watchlists, including:

- Custom watchlists you've created

- Default watchlists provided by the platform

- Shared watchlists from other users

Screener Results

Stocks identified by your custom screening criteria:

- Technical screener results

- Fundamental screener results

- Pattern-based screener results

- Custom expression screener results

Market Movers

Lists of stocks with significant market activity:

- Top gainers

- Top losers

- Most active stocks

- Unusual volume stocks

Portfolio Holdings

Stocks you currently own in your portfolios:

- Current positions in virtual portfolios

- Holdings in connected broker accounts

- Recently closed positions

Trading from Lists

Single Stock Trading

To trade a single stock from any list:

- Navigate to the list containing the stock you want to trade

- Find the stock in the list

- Click the Trade button or icon next to the stock

- In the trade dialog that appears:

- Select buy or sell

- Choose the order type (market, limit, etc.)

- Enter the quantity or dollar amount

- Select the portfolio to trade in

- Set any additional parameters (limit price, time in force, etc.)

- Review the order details

- Click Submit Order to execute the trade

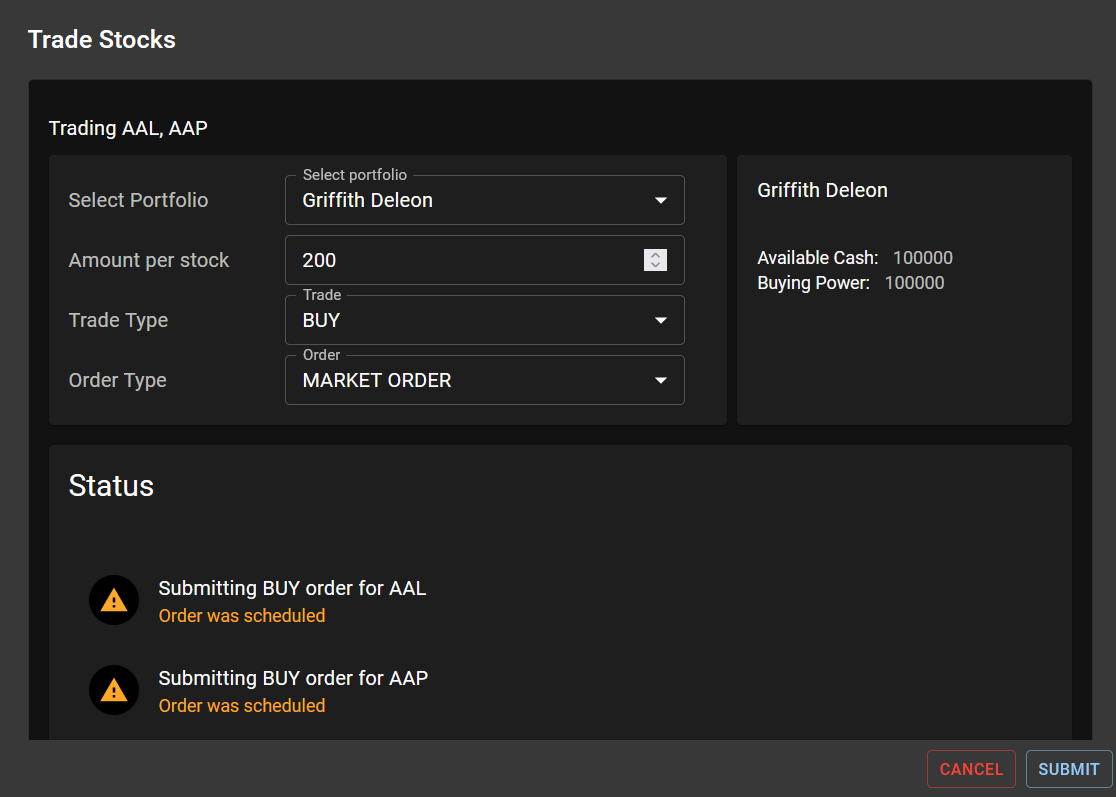

Bulk Trading

To trade multiple stocks simultaneously from a list:

- Navigate to the stock list

- Check the selection boxes next to the stocks you want to trade

- Click the Bulk Trade button at the top of the list

- In the bulk trade dialog:

- Select the action (buy or sell)

- Choose the order type (market, limit, etc.)

- Select the portfolio to trade in

- Choose allocation method (equal dollar amount, equal weight, custom)

- Enter the total amount to invest or number of shares per stock

- Set any additional parameters (limit prices, time in force, etc.)

- Review the order details for all selected stocks

- Click Submit All Orders to execute the trades

Advanced Trading Features

Quick Trade Templates

Save time by creating and using trade templates:

- Click the Save as Template option when setting up a trade

- Name your template (e.g., "5% Portfolio Buy", "Stop Loss Sell")

- Include any parameters you frequently use

- Access your templates from the dropdown menu when trading

Conditional Orders

Set up advanced order types directly from stock lists:

- Stop Orders: Set stop loss or stop limit orders

- Bracket Orders: Set take profit and stop loss levels simultaneously

- Trailing Stops: Set stops that adjust with price movement

- OCO (One-Cancels-Other): Create orders where execution of one cancels the other

Order Scheduling

Schedule trades to be executed at a future time:

- Set up your trade as normal

- Select the Schedule option

- Choose a specific date and time for execution

- Optionally, set recurring parameters (daily, weekly, monthly)

- Review and confirm the scheduled trade

Scheduled orders will appear in your Pending Orders section until they are executed or cancelled.

Best Practices

Efficient Research Workflow

Optimize your trading process:

- Create focused watchlists for different strategies or sectors

- Use screeners to find candidates that match your criteria

- Save screener results to watchlists for further analysis

- Execute trades directly when your analysis is complete

Risk Management

Maintain disciplined trading:

- Create trade templates with predefined position sizes

- Always use stop loss orders when trading from lists

- Be cautious with bulk trades to avoid overexposure

- Review all orders carefully before submission

For more information on executing trades, see our guides on Submitting Manual Trades and Automated Trading.