Algorithmic Trading Guides

Investfly: Advanced Algorithmic Trading Platform

Investfly is a comprehensive algorithmic trading platform designed to analyze the market and automate your stock trading strategies. It provides a wide range of market research tools, including real-time stock prices, charting, news feed, stock screener, and stock alerts to support your automated trading decisions.

Our automated trading platform supports various levels of automation, from simple standalone automated trade orders to complex algorithmic trading strategies with sophisticated entry and exit conditions. The best part is, you don't need any programming skills to define a trading strategy. Investfly's algo trading software allows you to express trading rules using simple mathematical formulas, similar to what you use in Microsoft Excel or other spreadsheet applications.

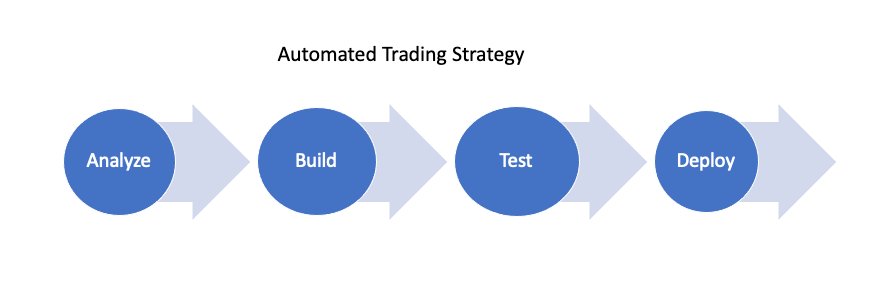

Investfly offers multiple ways to test and validate your algorithmic trading ideas, whether it's through backtesting or deploying your automated stock trading strategy to a virtual portfolio. And if you're ready to take your trading to the next level, Investfly also supports trading real stocks by connecting to your broker account. The following diagram outlines the high-level steps we expect our users to go through when using our algorithmic trading platform.

Who Should Use Our Algorithmic Trading Platform

Investfly is an ideal automated trading platform for day traders and swing traders who typically operate within minute, hour, and day timeframes, leveraging both fundamental and technical indicators for their algorithmic trading strategies. If your stock trading approach involves constantly monitoring multiple price charts with various technical indicators across multiple screens, you may be compromising your physical, visual, and mental well-being.

Our algorithmic trading software empowers you to automate standard trading strategies, such as trend following, breakout, and contrarian strategies based on indicators and chart patterns. This allows you to precisely define entry and exit points, leaving the execution to the system. However, Investfly is not optimized for high-frequency quant traders.

While we plan to expand our automated trading capabilities in the future, Investfly currently does not support the deployment of complex quant strategies, such as those based on AI/ML. Additionally, our end-to-end system latency, from receiving a new price quote to submitting a trade order, can be up to 10 seconds. This latency makes Investfly unsuitable for high-frequency trading, and we do not anticipate supporting this type of trading in the future.

Academic Algorithmic Trading Solution

Investfly also offers an academic algorithmic trading solution for universities to enable their students to get hands-on automated trading experience by using our trading simulator that supports stocks, options, and futures. The instructor dashboard allows professors to view all their students, track their activities and monitor their performance with algorithmic trading strategies in a risk-free environment.