Algorithmic Trading Guides

Custom Trading Indicators Development

Build proprietary technical indicators in Python to enhance your algorithmic trading strategies and gain a competitive edge.

Investfly's algorithmic trading platform provides a comprehensive library of standard technical indicators such as SMA, RSI, MACD, and more. These built-in indicators serve as the foundation for many successful algorithmic trading strategies and can be utilized in screeners, automated trade signals, and backtesting engines.

For algorithmic traders seeking a competitive advantage, Investfly enables you to develop custom technical indicators using Python code. These proprietary indicators can detect unique market patterns or signals that standard indicators might miss. Once defined, your custom indicators integrate seamlessly with all platform features (screening, trading strategies, backtesting) just like the standard indicators, giving you a powerful edge in your automated trading systems.

Developer Requirement

This guide assumes proficiency with Python programming and object-oriented concepts for developing algorithmic trading indicators.

Algorithmic Trading Indicator Architecture

Indicator Base Class

The Indicator class provides the foundational framework for

creating any type of technical indicator for algorithmic trading. Its

flexible design accommodates indicators based on various data inputs,

including price action, volume patterns, market sentiment, or alternative

data sources.

While we provide the SecurityDataProvider class for historical

market data access, advanced algorithmic traders can incorporate external

data sources using Python's requests module to create

indicators based on unique datasets like social media sentiment, options

flow, or macroeconomic indicators.

To develop a proprietary trading indicator, extend the

Indicator base class and implement these required methods:

IndicatorSpec Class

The IndicatorSpec class defines the metadata for your custom

algorithmic trading indicator, including its name, description, required

parameters, and output value type. This specification serves as the

blueprint for how your indicator will be presented and used throughout the

Investfly platform.

When implementing the getIndicatorSpec method, you must return

an instance of IndicatorSpec with all required metadata

properly defined:

Python Restrictions

Your custom indicator code runs in a restricted and sandboxed Python environment for security reasons. This ensures that the code cannot perform any malicious tasks on our servers. Only a few white-listed safe modules can be imported. System operations such as file IO are not allowed, and wildcard imports are also restricted.

If you find any safe function that is blocked, please contact us, and we can make it available.

Allowed Python Modules

- numpy

- pandas

- datetime

- math

- statistics

- random

- requests (limited)

- json

- collections

Computing Algorithmic Trading Signals

The core functionality of your custom indicator is implemented in the

computeSeries method. This method receives historical price data and

your indicator's parameters, and must return a series of dated values representing

your indicator's calculations.

Your algorithm should be optimized for performance since it will be executed in real-time when used in live trading strategies. The platform imposes a 1-second execution limit to ensure system responsiveness.

Example: Simple Moving Average Crossover Signal

Below is a complete example of a custom indicator that generates buy signals when a fast moving average crosses above a slow moving average:

Deploying Custom Indicators to Your Algorithmic Trading Platform

After defining your custom indicator class, you need to register it with Investfly's platform to make it available for use in your trading strategies, screeners, and charts.

Custom Indicator Registration

Navigate to User Settings > Custom Indicators in the Investfly platform. Paste your Python code into the editor and click "Save & Compile". Once successfully validated, your custom indicator will be available throughout the platform alongside standard indicators.

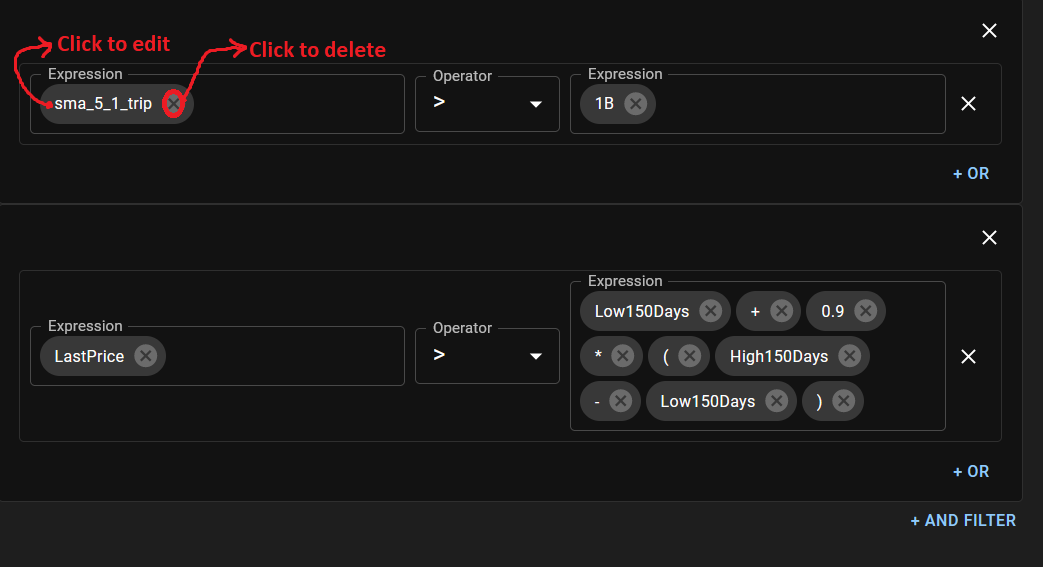

After deployment, your custom algorithmic trading indicator can be:

- Used in trading strategy conditions to generate automated trade signals

- Displayed on price charts for technical analysis

- Incorporated into stock screeners to find securities matching specific patterns

- Used in backtesting to evaluate historical performance

- Combined with other indicators to create complex algorithmic trading rules

Algorithmic Trading Indicator Best Practices

When developing custom indicators for algorithmic trading strategies, consider these best practices:

Performance Optimization

Optimize your code for speed using vectorized operations with NumPy whenever possible. The platform imposes a 1-second execution limit to maintain responsiveness during live trading.

Error Handling

Implement robust error handling to manage edge cases like insufficient data points or unexpected input values. Return appropriate fallback values when calculations cannot be performed.

Avoid Look-Ahead Bias

Ensure your indicator only uses data that would have been available at each historical point to prevent unrealistic backtesting results and false trade signals.

Thorough Testing

Extensively backtest your custom indicators across different market conditions and timeframes to validate their reliability before using them in live algorithmic trading.

Ready to Develop Your Edge

Custom indicators are the cornerstone of sophisticated algorithmic trading strategies. By developing proprietary technical indicators tailored to your specific trading methodology, you can gain a significant competitive advantage in the markets. Start creating your custom indicators today to enhance your automated trading systems.