Algorithmic Trading Guides

Visual Algorithmic Trading Logic Builder

Design precise algorithmic trading conditions with our intuitive no-code strategy designer.

Investfly's Expression Builder is a powerful visual tool for creating the logical conditions that drive automated trading strategies. If you haven't already, read the Algorithmic Trading Logic Overview to understand the fundamental concepts. This tool allows you to define sophisticated algorithmic trading rules for stock screening, market alerts, and automated trade execution—all without writing a single line of code.

Building Trading Algorithm Logic

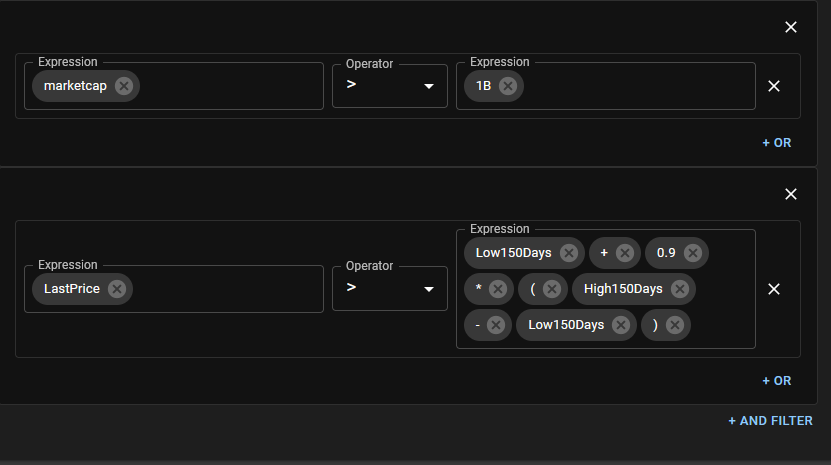

Algorithmic trading expressions are built using condition filters and filter groups. These logical structures allow you to create precise trading rules that can be combined to form complex algorithmic strategies.

Individual Trading Conditions

A filter contains one or more criteria combined using a logical OR operator, representing alternative conditions that can trigger your algorithmic trading signal:

MarketCap > 100B OR MarketCap < 100M

Combined Trading Algorithm Rules

A Filter Group combines multiple filters using the AND operator, requiring all conditions to be met for your automated trading system to execute:

(MarketCap > 100B OR MarketCap < 100M) AND (LastPrice > 1)

The example above demonstrates a complete algorithmic trading condition with two filter groups. The first group ((MarketCap > 100B OR MarketCap < 100M)) identifies either large-cap or micro-cap stocks, while the second group (LastPrice > 1) filters out penny stocks. Combined, they create a targeted algorithmic trading rule that focuses on specific market segments.

Algorithmic Trading Best Practice

For optimal performance, structure your algorithmic trading logic from most restrictive to least restrictive conditions. This helps the trading algorithm eliminate non-matching securities early, resulting in faster execution.

Building Your Trading Algorithm

In the Expression Builder interface, use the '+And Filter' button to add a new filter group (AND condition) or the '+OR' button to add alternative criteria within the same filter. You can remove any element by clicking the cross icon.

Creating Algorithmic Trading Rules

To build effective algorithmic trading strategies, you'll combine technical indicators, fundamental data, price information, and mathematical operators.

Configuring Technical Indicators for Algorithmic Trading

Technical indicators form the core of most algorithmic trading strategies. Our Expression Builder offers a comprehensive library of indicators that can be easily configured for your specific trading approach.

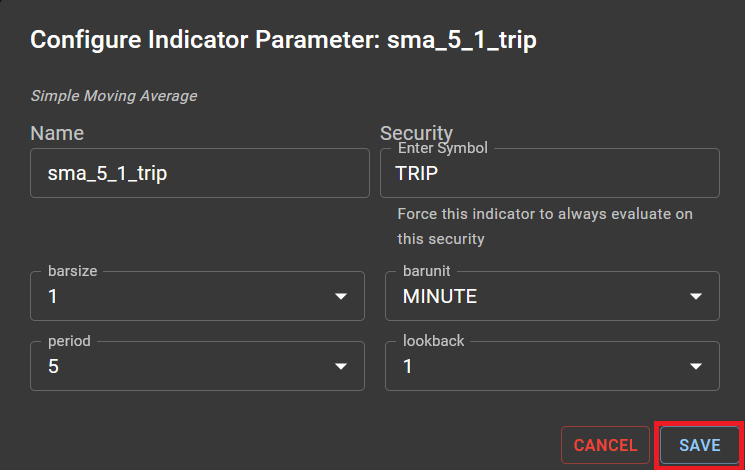

- Click the text input field to access the indicator selector. A drop-down list of available indicators will appear.

- Begin typing the name of a technical indicator (e.g., "RSI" or "MACD") to filter the list, or browse the complete selection of available indicators.

- Select your desired indicator to open the configuration dialog.

- Set the parameters for your technical indicator (e.g., period length, price field, calculation method).

- Click Save to add the configured indicator to your algorithmic trading rule.

- Add comparison operators and values to complete your trading condition.

Common Indicator Parameters for Trading Algorithms

Most technical indicators in algorithmic trading require specific parameter configurations:

| Parameter | Description | Algorithmic Trading Application |

|---|---|---|

| Period | Number of bars used in the calculation | Shorter periods create more responsive signals, while longer periods filter market noise in algorithmic strategies |

| Bar Interval | Time interval for each price bar (e.g., 1-min, 5-min, daily) | Determines the timeframe of your algorithmic trading strategy (day trading, swing trading, etc.) |

| Field | Price component used in calculations (open, high, low, close) | Close is commonly used for most algorithmic trading conditions, while high/low are valuable for breakout algorithms |

Common Algorithmic Trading Expressions

Below are examples of popular algorithmic trading conditions used in successful strategies:

Golden Cross Algorithm

A trend-following algorithmic strategy that generates buy signals when a short-term moving average crosses above a long-term moving average:

(EMA10 > EMA50) && (1 DAY AGO: EMA10 < EMA50)

This algorithm identifies emerging uptrends by detecting when the 10-day EMA crosses above the 50-day EMA.

RSI Reversal Algorithm

A mean-reversion algorithmic strategy that finds potential buy opportunities after oversold conditions:

(RSI14 > 30) && (1 DAY AGO: RSI14 < 30) && (VOLUME > AVGVOLUME20)

This algorithm identifies securities recovering from oversold conditions with above-average volume, suggesting a potential trend reversal.

Bollinger Band Squeeze Algorithm

A volatility breakout algorithmic strategy that detects potential explosive moves:

((BBWidth20_2 < 3.5%) && (5 DAYS AGO: BBWidth20_2 > 5%)) && (ADX14 > 20)

This algorithm identifies securities with narrowing Bollinger Bands (decreasing volatility) that may precede a strong directional move, confirmed by a rising ADX.

Advanced Algorithmic Trading Features

Historical Lookback

Access historical data points by using the "X DAYS AGO:" syntax in your algorithmic trading expressions. This enables pattern recognition and comparison of current conditions with past market behavior.

(CLOSE > 5 DAYS AGO: CLOSE * 1.1)

Complex Calculations

Enhance your algorithmic trading strategies with mathematical operations, allowing for percentage calculations, relative comparisons, and custom indicator ratios.

((HIGH - LOW) / CLOSE > 0.03)

Multi-Condition Logic

Create sophisticated algorithmic trading strategies with multi-level condition groups that combine various market factors in a single cohesive rule set.

((RSI < 30) || (BBLower - CLOSE < 0.5)) && (VOLUME > AVGVOLUME * 1.5)

Flexible Time Frames

Select different time intervals for each indicator in your algorithmic trading strategy, enabling multi-timeframe analysis for more reliable signals.

(EMA20_1DAY > EMA50_1DAY) && (MACD_15MIN > MACD_SIGNAL_15MIN)

Testing and Optimizing Algorithmic Trading Expressions

After creating your algorithmic trading conditions, it's essential to validate their effectiveness:

- Preliminary Testing: Use the stock screener to see which securities your algorithmic conditions currently identify.

- Backtest Verification: Apply your expression in a trading strategy and run backtests to assess historical performance.

- Parameter Optimization: Adjust indicator parameters to find optimal settings for your algorithmic trading strategy.

- Virtual Portfolio Validation: Before using real capital, deploy your algorithmic strategy to a virtual portfolio to monitor live performance.

Algorithmic Trading Strategy Tip

The most robust algorithmic trading strategies typically combine multiple types of technical indicators (trend, momentum, volatility) with fundamental filters. This multi-factor approach reduces false signals and improves consistency across different market conditions.